Insurance is born long time ago. At that time, the boats traveled the world loaded with precious goods, like gold or spices. For these boats were worth very expensive, travel was dangerous because they could be attacked by hackers or be washed away by terrible storms. When that happened, all the goods were swallowed up in the deep water and the merchants were ruined. Boat owners have decided to invent INSURANCE

The Car insurance is a bit different:

Source: Insurance Hotline

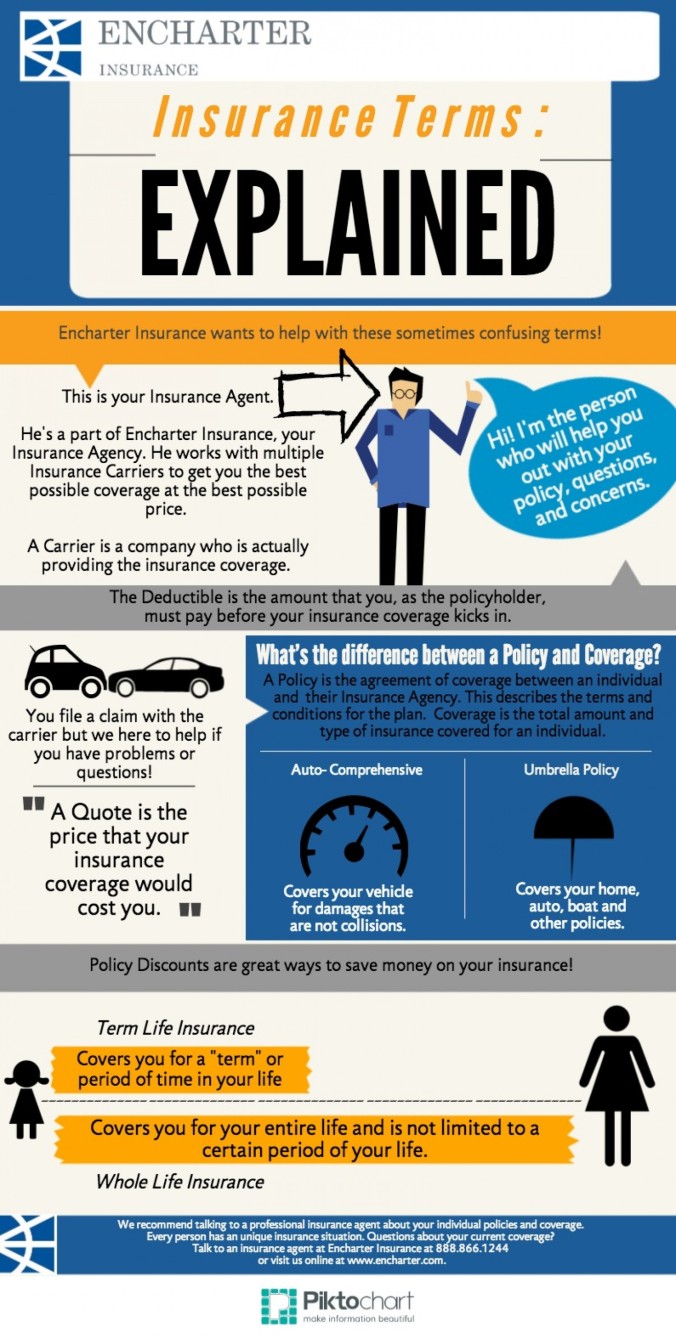

What is an Insurance Company and what does it do?

Insurance is a means of getting financial coverage in case of some mishappening and the company that provides insurance is called as insurance company. In other words insurance company is a company that sells insurances. Insurance is getting popular day by day and the insurance companies are too getting progress at a fast pace. Insurance is considered as a safe investment to safeguard our interests.

There are many kinds of insurances that are offered by the insurance companies. You can have your life insured or your louse insured or your vehicle insured or your business insured by the different insurance companies. Insurance companies provide coverage to their customers for specific losses in future and in return these insurance companies receive small installments from the customers that are called as insurance premium.

Insurance premium is decided by the insurance company after taking into consideration the information in relation to the type of insurance they are providing. For example in life insurance the premium will be based upon the present medical condition of the person, his age, medical history of his parents etc. in similar way the premiums of all the insurance policies are decided by the insurance company on the basis of the information that they require in relation with the insurance policy.

In return of the insurance premium the customers of the insurance company receive written agreement from the company that is called as policy document. All the terms and conditions in relation to a particular type of insurance are mentioned in the policy document. It is clearly mentioned in the policy document that what will be the conditions in which the insurance company will provide coverage to the policy holder. The details that you furnish to the insurance company about the insurance you require must be true unless the insurance company can cancel your policy also.

Insurance company collects premium from large section of policy holders and it will require paying for a few losses. Actually insurance companies run their business on probability basis. They use the data related to the history about the occurrence of certain events and then they calculate premiums to cover those losses and making profits for themselves.

This can be well explained with the help of an example. Let us suppose that there are about 100 houses in some area and each of the houses is worth $100000. Now if all the houses are insured by the same insurance company then it will study the data in relation to the fire incidents in that area. The history reveals that there are about 1-2 houses in that area that are damaged by fire in that area on an average. Now the insurance company will require having $100000 in its bank account to rebuild a single house in that locality. Now it will charge $2000 from all the house owners so that it will have enough money to rebuild two houses in that area. This amount will be then raises to some extent as a profit margin of the insurance company. This is the way in which an insurance company works.

Insuring a car, the driver and passengers

The content of the insurance policy is essential , both for driving and for the vehicle itself or the management of damage to third parties or to the driver . If an old car requires may not be assured all risks , its driver, whether primary or secondary, must be able to receive coverage covers damages suffered . That’s what serves the conducting individual insurance with a generally more moderate cost.

Because it represents a risk to third parties, an unused car must still be ensured . The owner remains in effect responsible and therefore must compensate victims in case of disaster. He is also responsible when his car ready and especially to a novice driver who may be a child or another person, without having notified its insurer. If fault accident, then the company will indemnify the damage to third parties for accountability, but can reduce or refuse to take into account the injuries to the driver and the car repairs.

Below you can find an useful infographic from Enchanter: